Understanding the Investment Climate of Pakistan

Written by Mahnoor Abdul Basit

Pakistan’s investment climate can be difficult to navigate for national and international stakeholders alike. This article provides a targeted overview of the aspects that influence the investment space of the entrepreneurial ecosystem, providing valuable insights from both investors and startups. Understanding these dynamics is essential for early-stage ventures looking to secure funding, scale operations, and make informed strategic decisions. By exploring historical trends, current economic indicators, and future projections, it highlights the opportunities and challenges of investing in Pakistan and gives tips on maneuvering through its evolving economic landscape.

Overview of Pakistan’s Investment Climate

Historical Context:

Pakistan’s investment landscape has evolved over the years, shaped by periods of economic liberalization, foreign capital inflows, and policy-driven shifts. While the 1990s marked a phase of privatization and deregulation, the early 2000s saw a rise in foreign direct investment (FDI) driven by improvements in macroeconomic stability and investor-friendly policies. However, external shocks, political instability, and inconsistent economic policies have repeatedly disrupted sustained growth.

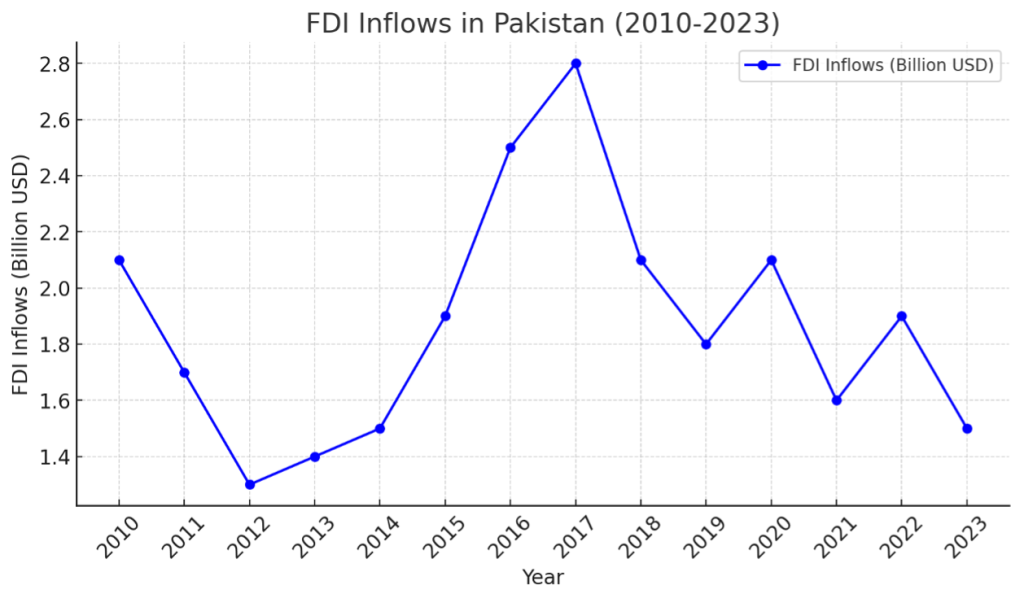

Over the past decade, FDI trends in Pakistan have followed a cyclical pattern, influenced by global economic shifts, domestic policy changes, and geopolitical dynamics. The early 2010s witnessed an influx of investment, particularly in energy and infrastructure, catalyzed by the China-Pakistan Economic Corridor (CPEC), which brought in billions of dollars. However, FDI declined post-2018 due to external debt concerns, political uncertainty, and a deteriorating business climate. According to the State Bank of Pakistan (SBP), FDI inflows peaked in 2017 at approximately $2.8 billion before witnessing a decline, reaching $1.5 billion in 2022. The Covid-19 pandemic further slowed global capital movements, impacting investment inflows into the country.[1]

While there have been periods of increased inflows, recent trends indicate a concerning decline. In January 2024, Pakistan experienced a net FDI outflow of $173.2 million, marking a six-year high and reflecting growing investor apprehension amid political uncertainty and economic instability. Although there was a 32% increase in net FDI to $904 million during July–October FY25 compared to the same period the previous year, the inflows remain modest relative to the country’s needs.[2]

Beyond CPEC, sectors such as telecommunications, financial services, manufacturing, and technology startups have historically attracted substantial investment. The telecom sector, particularly with the entry of foreign players like Telenor and Jazz, received significant FDI in the early 2000s. The banking sector saw interest from international financial institutions, while manufacturing—especially in textiles and consumer goods—remained a key area for investment. In recent years, venture capital investment in Pakistani startups has gained traction, with over $350 million raised in 2021 alone, marking a shift toward technology-driven economic activity.[3]

Despite these promising developments, Pakistan has struggled to fully leverage its investment potential due to a lack of economic branding. Unlike regional competitors, the country has not effectively marketed its economic strengths—such as a young, globally competitive workforce and strategic trade access to East Asia, South East Europe, and the Middle East. Instead, geopolitical narratives of instability have overshadowed the real opportunities available, especially for its growing entrepreneurial ecosystem.

The line graph above illustrates Pakistan’s FDI inflows from 2010 to 2023.

Current Economic Indicators:

GDP Growth: the Pakistani economy is projected to grow at 2.5% in FY2025, with improvements expected in the services and agriculture sectors.[4]

Inflation stood at 23.41% in FY2024 as compared to the previous year but is expected to improve as fiscal measures take effect, such as tax reforms, subsidy rationalization, and investment-friendly policies. The government has introduced tax incentives for businesses, including reduced corporate tax rates and exemptions for Special Economic Zones (SEZs), to attract investment. Additionally, energy sector subsidies for industries, along with export rebates and duty drawbacks, aim to boost economic activity. Public spending on infrastructure projects under the Public Sector Development Program (PSDP) and CPEC initiatives is also expected to stimulate growth. Furthermore, fiscal consolidation measures, including IMF-backed policy adjustments and debt management strategies, are likely to enhance macroeconomic stability and investor confidence.

Currency Stability: The Pakistani Rupee has stabilized recently following an IMF bailout and improved remittance inflows, with an increase of 24% in foreign exchange reserves as compared to the previous year. This improvement is driven by higher worker remittances, a narrowing current account deficit, and stringent fiscal measures aimed at stabilizing the economy.

Key Industries of Opportunity:

- Tech Startups

Pakistan’s tech startup ecosystem has seen unprecedented growth in recent years, driven by a young, digitally literate population and increasing investor interest. In 2022, Pakistani startups raised over $350 million in funding despite global economic slowdowns, showcasing the resilience and potential of the sector.

Pakistan’s freelancing sector is a key driver of the tech economy, contributing over $1 billion annually. In FY24 (July 2023 – March 2024), freelancers generated $350.15 million in foreign exchange earnings. The average monthly income ranges from PKR 40,058 to PKR 62,498, depending on skills and experience. With a 27% increase in earnings in recent years, Pakistan ranks among the fastest-growing freelancing markets globally, strengthening its position in the digital economy.[5]

This rapid digital transformation is not only evident in the rise of individual freelancers but also in the growth of tech-driven startups that are reshaping the local ecosystem. Notable examples include:

Airlift:

Airlift was a Lahore-based startup that initially launched as a mass transit service, offering affordable, app-based bus rides. During the pandemic, it pivoted to quick commerce, delivering groceries and essentials within 30 minutes. In 2021, it made headlines by securing $85 million in Series B funding, the largest single private investment in Pakistan’s startup history.

However, despite its rapid rise, Airlift shut down in 2022 due to a series of financial and operational challenges:

Over-Reliance on External Funding – Airlift’s aggressive expansion into quick-commerce required heavy subsidies and high burn rates, making it dependent on continuous funding rounds. When the global funding climate tightened, it struggled to secure capital.

Economic Downturn & Inflation – Rising inflation and a depreciating rupee increased operational costs, while reduced consumer spending hurt revenues.

Expansion Beyond Market Capacity – The company expanded operations into South Africa, stretching resources too thin instead of consolidating its home market.

Unit Economics & Profitability Issues – High logistics costs and discounts meant negative margins per order, making the business unsustainable in the long run.

Investor Hesitation – The 2022 global tech downturn made venture capitalists more cautious, and Airlift failed to secure its next funding round, forcing a shutdown.

Airlift’s downfall serves as a cautionary tale for Pakistani startups. It underscores the importance of profitability over rapid scaling, adapting to economic realities, and ensuring financial self-sufficiency rather than relying solely on venture capital.

Bykea:

Bykea is a Karachi-based startup that provides bike-based ride-hailing, delivery, and payment services through its mobile app. Launched in 2016, it caters to Pakistan’s middle and lower-income segments, offering affordable transportation, parcel delivery, and cash-based financial transactions. Bykea managed to secure $10 million in funding in 2022 to expand its mobility and logistics services.

With internet penetration exceeding 36% and a growing e-commerce market (valued at $4 billion in 2022), the tech sector continues to attract significant domestic and international investment.

- Agriculture

Agriculture remains a cornerstone of Pakistan’s economy, contributing 23% to GDP and employing 38.5% of the labour force. Modernization efforts, such as precision agriculture and smart irrigation systems, are improving productivity.[6]

Key Crops & Exports: Pakistan is the 4th largest producer of cotton and a leading exporter of rice. Additionally, sugarcane is a major crop, supporting the large domestic sugar industry, though challenges like inefficiencies and price volatility persist.

Agriculture Transformation Plan: This government initiative promotes mechanization, digital farming, and subsidies to boost crop yields. Agri-tech startups like Tazah are also leveraging technology to streamline supply chains and reduce waste.

Halal Meat Potential: With a large livestock population, Pakistan has significant untapped potential in halal meat exports. While the country exports to the Middle East and Southeast Asia, it has yet to fully capitalize on the $2 trillion global halal food market. Investments in modern slaughterhouses, cold chain logistics, and quality certifications could help Pakistan establish itself as a major supplier to Europe, Central Asia, and Africa, where demand for halal-certified meat is rising.

- Textiles

The textile industry is a cornerstone of Pakistan’s export economy, accounting for over 60% of total exports, valued at approximately $19 billion in FY2023. Leading textile firms such as Style Textile ($522 million), Interloop Ltd. ($423 million), Nishat Mills Ltd. ($381 million), Artistic Milliners ($330 million), and Gul Ahmed Textiles ($302 million) have played a crucial role in driving this growth. Pakistani manufacturers supply products to major global brands, including Zara, H&M, C&A, Bestseller, Adidas, Next, Mango, and Forever 21. Government incentives such as duty drawbacks, subsidized utility rates, and export refinancing have strengthened the sector, while the EU’s GSP+ trade incentive has further boosted demand. The rise of sustainable fashion and organic cotton trends also presents new investment opportunities. With a strong infrastructure and increasing global demand, Pakistan remains a key player in the international textile market.

- Clean Tech

With rising energy demand and environmental concerns, Pakistan is focusing on clean tech as a critical sector for investment. The country boasts an estimated potential of 50,000 MW from wind energy and 2.9 million MW from solar energy. Key initiatives include:

- The Jhimpir Wind Corridor, where over 1,000 MW of energy is being generated from wind projects.

- The Quaid-e-Azam Solar Park, with a capacity of 1,000 MW, is one of the largest solar projects in the region.

- The Alternate and Renewable Energy Policy 2019 aims to generate 30% of electricity from renewable sources by 2030.

- International investors, including China and the UAE, are actively participating in clean tech projects, signaling the sector’s potential for high returns and sustainable growth.

- Pakistan’s electric vehicle (EV) sector is experiencing significant growth, driven by both local initiatives and international collaborations. Chinese manufacturers like Changan and BYD have announced plans to introduce EVs into the Pakistani market. Notably, BYD is partnering with Hub Power’s subsidiary, Mega Motor, to establish Pakistan’s first EV assembly plant by 2026, aiming to position the country as a key automotive export hub targeting regions such as Africa and South Asia.

In support of this evolving landscape, Lahore University of Management Sciences (LUMS) has inaugurated an E-Mobility Research and Development Center. This center focuses on advancing EV technologies to address environmental challenges like air pollution and climate change, aligning with national goals for EV adoption by 2030.

LUMS also hosted the 2nd Symposium on Battery Electric Vehicles (BEVs) in collaboration with HEC Pakistan, the World Bank, and IFC, focusing on ‘Accelerating the Electric Mobility Transition in Pakistan.’ The event brought together policymakers, academics, and industry leaders to discuss progress, challenges, and strategies for advancing EV adoption in line with global trends.

- Rawana, a startup in the Idea Launch cohort at LUMS Center for Entrepreneurship (LCE), is revolutionizing last-mile delivery with electric vehicles, promoting sustainable urban transportation through efficient and eco-friendly mobility solutions.

- Voltshare Technologies, part of the Slingshot Accelerator cohort at LUMS Center for Entrepreneurship (LCE), is connecting EV drivers to real-time charging stations, reducing range anxiety and supporting Pakistan’s growing electric mobility ecosystem.

Government Initiatives:

The Pakistani government has implemented several strategic measures to attract investment and improve the business climate:

Tax Reforms & Incentives: The government has introduced tax amnesty schemes, reduced corporate tax rates for IT exports, and exemptions for startups to encourage business formalization and attract FDI. In the latest budget, IT and freelancing sectors were granted tax exemptions and incentives to boost Pakistan’s digital economy.

Special Economic Zones (SEZs) under CPEC: Pakistan has established nine SEZs, including Rashakai, Allama Iqbal, and Dhabeji SEZs, aimed at attracting both local and foreign investors by offering tax holidays, duty-free imports on machinery, and infrastructure support. These SEZs are positioned to boost manufacturing, particularly in automobile, textile, and pharmaceuticals. However, bureaucratic delays and inconsistent policies have slowed their full potential.

Ease of Doing Business Reforms: Pakistan improved its ranking in the World Bank’s Ease of Doing Business Index from 136th in 2018 to 108th in 2020 before the rankings were discontinued.[7] Key reforms included simplifying business registration through the SECP, introducing online tax filing systems, and reducing approval times for construction permits and electricity connections. However, challenges remain in contract enforcement and dispute resolution, deterring long-term foreign investment.

While these initiatives signal progress, policy inconsistency, political uncertainty, and economic volatility remain key challenges in fully leveraging these reforms to attract sustainable investment.

Regional and International Investment Trends:

Pakistan’s strategic location provides access to South Asia, Central Asia, and the Middle East, making it a potential investment hub. Recent trends show growing FDI in technology, renewable energy, and infrastructure, particularly through CPEC-driven SEZs and fintech expansion. However, macroeconomic challenges and policy uncertainty continue to impact investor confidence.

Globally, investment trends are shifting toward sustainable development, digital transformation, and AI-driven innovation. Countries are prioritizing green energy, supply chain diversification, and smart manufacturing to mitigate economic volatility. Pakistan must align with these global trends to attract long-term, high-value investments.

Key Challenges:

Economic Instability: Persistent fiscal deficits, external debt obligations, and currency fluctuations create economic uncertainty, impacting investor confidence.

Political and Security Concerns: While political transitions and regional tensions have historically posed challenges, improving security metrics offer hope for a more stable business environment.

Regulatory Framework: Complex bureaucratic processes, unclear tax policies, and inconsistent regulations remain major hurdles for local and foreign investors.

Expert Opinions:

To understand the evolving investment landscape in Pakistan, we gathered expert insights on investor priorities, market opportunities, and key factors that drive funding decisions.

Hammad Umer, an experienced investment manager and head at Inistor, highlighted the evolving priorities in the investment space: “Investors are now more conscious of valuations and selective in their investments. Governance practices play a crucial role in building trust and attracting funding.” He advised entrepreneurs to collaborate, explore new opportunities, and adopt a strategic vision for long-term growth.

He also underscored the potential of cleantech, stating, “Sectors like mobility and alternative fuels hold significant promise, though they remain underdeveloped. However, with the government introducing favorable energy policies, there is a strong opportunity for innovation and growth in these industries.”

With nearly three decades of experience in software development and technology services, Dr. Salman Iqbal, founder of Denovonet, pointed to IoT innovations in healthcare as a promising investment area. He shared that his company developed a smart diaper that alerts caregivers via text message when it needs changing. His advice to startups: “Focus on the problem you want to solve and assess its long-term monetization potential.”

He also emphasized the transformative potential of emerging technologies, stating, “The next major shift will be in generative AI. As more innovators explore its applications, it will become a powerful tool for problem-solving and delivering value to customers. Prompt-based AI, in particular, offers new opportunities to enhance efficiency and improve everyday experiences.”

Success Stories and Investment Trends

International Firms: Companies like Coca-Cola have made billion-dollar investments in Pakistan, showcasing confidence in its consumer market.

Local Startups: Success stories like Bykea and Careem illustrate how tech-driven innovation can thrive despite economic challenges.

Renewable Energy Projects: The Jhimpir Wind Corridor and other initiatives have attracted international partnerships, underscoring clean energy’s potential.

What Investors Look For:

- Scalability: Startups in e-commerce, fintech, and healthcare that leverage technology for rapid growth are particularly attractive.

- Market Size: With a population exceeding 240 million, Pakistan offers a vast consumer base, especially in urban centers.

- Growth Potential: High-growth industries like clean energy, agri-tech, and digital financial services align with both local needs and global investment trends.

Actionable Advice for Investors:

Form Strategic Partnerships: Collaborating with local businesses helps investors navigate regulatory challenges and gain market insights.

Understand the Business Culture: Personal relationships and trust play a crucial role in securing long-term business success in Pakistan.

Leverage Government Incentives: SEZs offer tax benefits and simplified regulations, particularly for manufacturing and tech sectors.

Plan for Market Challenges: Investors should prepare for currency fluctuations and bureaucratic hurdles with diversified portfolios and localized risk assessments.

Startup Lessons:

The investment climate in Pakistan is evolving, creating new opportunities for startups. However, many entrepreneurs struggle with raising capital, navigating regulations, and achieving long-term growth.

Muhammad Umer Hassan and Talha Dar, founders of Markhor 3D, a STEM-focused hardware startup, shared their experiences:

- Many investors favored quick-return software startups over hardware ventures.

- Political instability and foreign policy challenges deterred international investors, including one from China.

- Despite multiple rejections, they shifted focus to self-funding, revenue generation, and strategic partnerships.

- Their persistence paid off when angel investor Bilal Ahmed came on board, emphasizing the importance of finding the right supporters.

Key Takeaways for Startups:

- Understand Investor Expectations: Demonstrate scalability, profitability, and clear business models to attract funding.

- Utilize Funding Effectively: Investments should be allocated to product development, market expansion, and operational efficiency.

- Leverage Local Ecosystems: Engage with incubators like LUMS Center for Entrepreneurship (LCE), for mentorship and funding opportunities.

- Adapt to Funding Challenges: With global funding markets tightening, startups must explore local venture capital, crowdfunding, and alternative revenue streams.

- Stay Resilient: Persistence, adaptability, and a strong vision are crucial for long-term success.

Pakistan’s startup ecosystem is at a pivotal moment, with increasing venture capital inflows, digital transformation, and government initiatives fueling growth. However, strategic navigation, strong governance, and adaptability are essential to overcoming investment challenges. For investors and entrepreneurs alike, Pakistan presents both risks and immense opportunities, making it a market worth watching.

- Conclusion

Pakistan’s investment climate is evolving, driven by a combination of strategic reforms and emerging opportunities. The government has introduced investor-friendly policies, including tax incentives, simplified regulatory frameworks, and the development of Special Economic Zones (SEZs) under the China-Pakistan Economic Corridor (CPEC), which offer duty exemptions and infrastructure support. Efforts to stabilize the economy through fiscal consolidation and improving ease of doing business rankings have further enhanced investor confidence. Moreover, the growing focus on sectors like renewable energy, technology, and value-added agriculture reflects a shift towards modernization. With a young, tech-savvy population, increasing urbanization, and a rising middle class, Pakistan is positioning itself as a dynamic regional hub for trade and investment.

[1] State Bank of Pakistan, Summary of Foreign Investment in Pakistan, 2024, https://www.sbp.org.pk/NetinflowSummary

[2] Dawn, November 19, 2024. https://www.dawn.com/news/1873377.

[3] Ministry of Information Technology & Telecommunication. Yearbook 2021–22. Government of Pakistan. Accessed May 19, 2025. https://www.moitt.gov.pk/SiteImage/Downloads/MoITT-YB-21-22.pdf.

[4] Asian Development Bank. “ADB Forecasts Pakistan’s Economy to Grow 2.5% in FY2025, as Reforms Take Effect.” News release, April 9, 2025. https://www.adb.org/news/adb-forecasts-pakistan-economy-grow-2-5-fy2025-reforms-take-effect.

[5] Mettis Global. “Freelancers’ Remittances Reach $350.2m in July–March FY2024: Survey.” Mettis Global News, June 12, 2024. https://mettisglobal.news/freelancers-remittances-reach-350-2m-in-july-march-fy2024-survey/.

[6] Finance Division, Government of Pakistan. Pakistan Economic Survey 2023–24: Chapter 2 – Agriculture. https://www.finance.gov.pk/survey/chapter_24/2_agriculture.pdf

[7] State Bank of Pakistan. “Ease of Doing Business (EODB) Index.” https://www.sbp.org.pk/FS/Ease/Ease-r.html

Comments are closed.